1. Introduction

Overview of Bahrain as a Business-Friendly Destination

Bahrain has established itself as one of the most attractive destinations for business and investment in the Middle East. Strategically located in the heart of the Gulf Cooperation Council (GCC), Bahrain offers an open economy, minimal taxation, and a well-regulated business environment that fosters growth. With a pro-business government, streamlined registration processes, and access to regional and international markets, Bahrain is an ideal location for entrepreneurs and corporations alike.

Key Benefits of Registering a Business in Bahrain

- 100% Foreign Ownership – Unlike many neighboring countries, Bahrain allows full foreign ownership of companies in several sectors.

- No Corporate Tax – Bahrain does not impose corporate taxes on most businesses, making it a tax-efficient jurisdiction.

- Ease of Doing Business – Ranked favorably in global indices, Bahrain has simplified business registration and licensing procedures.

- Skilled Workforce – The country boasts a highly skilled and bilingual workforce, making recruitment easier.

- Access to GCC Markets – Bahrain provides a gateway to the larger GCC market, enabling companies to expand regionally.

- Advanced Infrastructure – With world-class logistics, banking, and telecommunication services, Bahrain offers a supportive business environment.

Types of Businesses That Can Be Registered

- Commercial and Industrial Companies

- Professional Service Firms

- Technology Startups

- Manufacturing and Logistics Firms

- Real Estate and Construction Companies

- Retail and E-Commerce Businesses

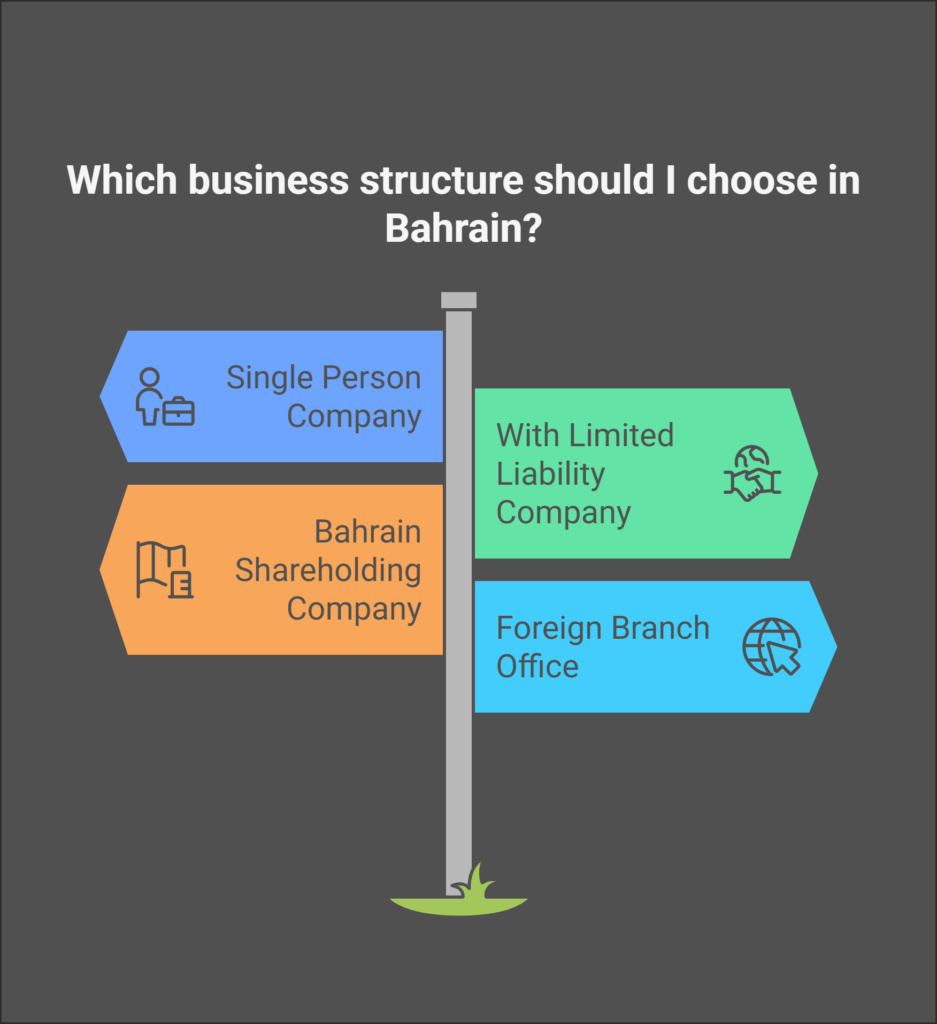

2. Understanding the Business Structure

Choosing the right business structure is crucial for operational efficiency, legal compliance, and financial management. Bahrain offers several types of business entities to accommodate different business needs.

Different Types of Legal Entities in Bahrain:

Single Person Company (SPC)

An SPC is a limited liability company owned by a single individual or entity. It provides liability protection and is ideal for small to medium-sized businesses looking for flexibility and simplicity.

- Minimum capital requirement: BHD 50 (varies by industry)

- The owner has full control over business decisions

- Suitable for entrepreneurs and small enterprises

With Limited Liability Company (WLL)

A WLL is a popular choice for small and medium enterprises. It can have multiple shareholders (up to 50) and offers limited liability protection.

- Minimum capital requirement: BHD 20,000 (for certain industries)

- Cannot engage in banking or insurance activities

- Ideal for trading, services, and consulting businesses

Bahrain Shareholding Company (BSC – Closed & Public)

A Bahrain Shareholding Company can be either closed (BSC Closed) or publicly listed (BSC Public).

- BSC Closed: Minimum of two shareholders, not publicly traded

- BSC Public: Minimum of seven shareholders, listed on the Bahrain Bourse

- Requires a board of directors

- Suitable for large-scale enterprises, banking, and investment firms

Foreign Branch Office

International companies can set up a branch office in Bahrain to operate without forming a separate legal entity.

- No minimum capital requirement

- The parent company is liable for all obligations

- Ideal for foreign businesses looking to expand their footprint in Bahrain

Partnerships & Joint Ventures

Bahrain allows both general and limited partnerships, which involve multiple individuals or entities sharing profits, responsibilities, and liabilities.

- General Partnerships: All partners share unlimited liability

- Limited Partnerships: At least one partner has unlimited liability, while others have limited liability

- Common for professional firms and consultancy businesses

Free Zone Companies (Benefits & Regulations)

Bahrain offers Free Zones that provide specific benefits, particularly for logistics, manufacturing, and technology businesses.

- Benefits:

- 100% foreign ownership

- Exemption from customs duties

- Simplified visa and labor laws

- Regulations:

- Must operate within the designated free zone areas

- May have restrictions on selling directly in the local market

- Popular free zones include Bahrain Logistics Zone (BLZ) and Bahrain International Investment Park (BIIP)

Choosing the Right Business Structure for Your Needs

When selecting the appropriate business structure, consider the following factors:

- Nature of Business Activities – Some industries have specific legal requirements.

- Ownership Preferences – Foreign investors may prefer SPC or WLL for ease of ownership.

- Liability Considerations – Limited liability structures are preferable for risk management.

- Expansion Plans – If you plan to scale, a BSC Public may be more suitable.

- Capital Requirements – Each entity type has different financial obligations.

3. Pre-Registration Requirements

Starting a business in Bahrain requires careful planning and compliance with government regulations. Before registering a company, entrepreneurs must complete several key steps to ensure their business is set up for success.

Defining the Business Activity Based on Bahrain’s Commercial Registry

Bahrain’s Commercial Registry categorizes business activities into different sectors, such as trade, manufacturing, real estate, professional services, and more. Entrepreneurs must define their business activity clearly, as certain activities may require additional approvals or licenses.

Choosing a Unique Business Name & Trade Name Registration

Selecting a business name is a crucial step. The chosen name must be unique and comply with Bahrain’s naming conventions, including:

- Avoiding prohibited or offensive words

- Not duplicating an existing registered business name

- Including specific legal entity indicators (e.g., WLL, BSC, SPC)

Business names must be reserved through the Ministry of Industry and Commerce (MOIC), and approval must be obtained before proceeding with the registration process.

Understanding Foreign Ownership Regulations

Bahrain offers foreign investors attractive ownership benefits, including 100% foreign ownership in most sectors. However, some industries, such as banking, insurance, and telecommunications, require local partnerships or additional regulatory approvals. Investors should check Bahrain’s Foreign Investment Law to determine ownership eligibility.

Minimum Capital Requirements for Different Business Types

The minimum capital requirement varies depending on the business structure:

- Single Person Company (SPC): No minimum capital requirement

- With Limited Liability Company (WLL): No minimum capital requirement

- Bahrain Shareholding Company (BSC – Closed): BHD 250,000

- Bahrain Shareholding Company (BSC – Public): BHD 1,000,000

- Foreign Branch Office: No minimum capital requirement, but financial statements from the parent company may be required

Finding a Suitable Office Location (Virtual Office vs. Physical Space)

Bahrain allows businesses to operate from:

- Physical Offices: Required for industries that need on-site operations (e.g., retail, manufacturing)

- Virtual Offices: Suitable for startups, consulting firms, and businesses that do not require a physical location

Companies registered in free zones must operate within the designated zones. Choosing the right office setup depends on the nature of the business and its regulatory requirements.

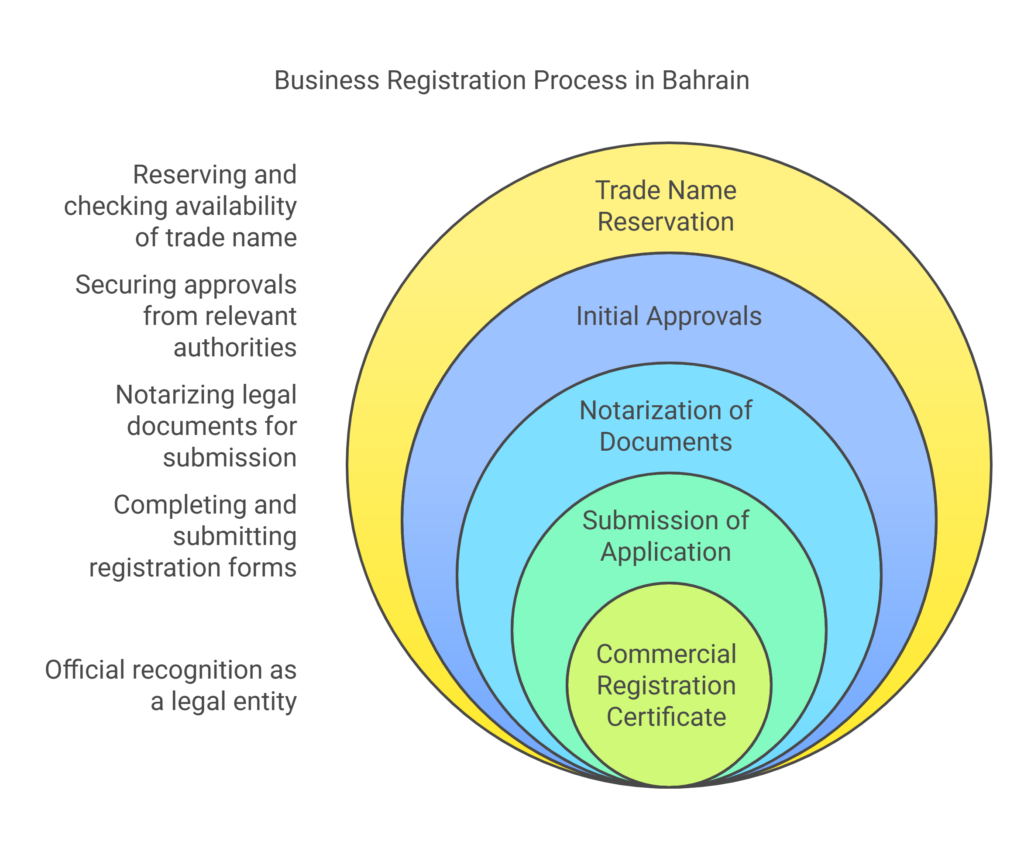

4. Step-by-Step Business Registration Process

Registering a business in Bahrain involves several key steps. Below is a breakdown of the registration process:

Step 1: Reserve the Trade Name

A business name must be reserved before the official registration process begins.

How to Check Name Availability

- Entrepreneurs can check the availability of their desired business name through Sijilat, Bahrain’s online commercial registration system.

- The name must comply with MOIC’s regulations and not conflict with existing trademarks or brand names.

MOIC Requirements for Trade Name Approval

- The name must not resemble or infringe upon existing trademarks.

- Certain names may require additional approvals (e.g., financial or healthcare-related terms).

- If the name includes foreign words, an Arabic translation may be required.

Step 2: Obtain Initial Approvals

Once the trade name is approved, businesses must secure initial approvals from the MOIC and other relevant authorities.

Necessary Approvals from MOIC and Other Government Bodies

- The MOIC reviews the business structure, ownership details, and activity classification.

- Businesses in regulated industries, such as finance, education, and healthcare, must obtain approval from sector-specific authorities, such as:

- Central Bank of Bahrain (CBB) for financial institutions

- National Health Regulatory Authority (NHRA) for healthcare businesses

- Telecommunications Regulatory Authority (TRA) for telecom-related businesses

Special Licenses for Regulated Industries

Some business activities require special licensing, which may involve additional documentation and compliance measures. Examples include:

- Banking and financial services → Requires Central Bank of Bahrain approval

- Restaurants and food services → Requires municipality and health ministry approvals

- Import/export businesses → Requires customs clearance and trade licenses

Step 3: Draft & Notarize Business Documents

Once initial approvals are obtained, businesses must prepare and notarize their legal documents. These documents define the company’s structure, ownership, and operational guidelines.

Articles of Association (AOA) & Memorandum of Association (MOA)

The Articles of Association (AOA) and Memorandum of Association (MOA) are two key legal documents required for company registration in Bahrain:

- Memorandum of Association (MOA):

- Defines the company’s objectives and scope of operations

- Specifies shareholder details and their respective shares

- Includes the registered office address and company duration

- Articles of Association (AOA):

- Outlines the internal management structure of the company

- Defines rules for appointing directors and decision-making processes

- Includes regulations on share transfers, profit distribution, and governance

Other Required Legal Documents

In addition to the MOA and AOA, companies may need to submit:

- Board Resolution (for corporate shareholders): Authorizing company registration and appointing representatives

- Power of Attorney (if applicable): If a third party is handling the registration process

- Lease Agreement: Proof of a registered office (for physical offices)

- Special Licenses (if applicable): Depending on the industry, additional approvals may be required

Notarization Process

All legal documents must be notarized by a licensed notary in Bahrain. The notarization process typically involves:

- Submitting the draft documents for review

- Verifying shareholder details and business activity compliance

- Attesting the documents through a Notary Public or the Ministry of Justice

Once notarized, the business can proceed to formal registration.

Step 4: Register with the Bahrain Commercial Registry

After preparing and notarizing the necessary documents, businesses must register with the Bahrain Commercial Registry through the Sijilat system, Bahrain’s online business registration portal.

Submitting the Application Through the Sijilat System

The Sijilat portal (https://www.sijilat.bh/) is the official online platform for commercial registration in Bahrain. Businesses can complete their registration through the following steps:

- Log in to Sijilat using a registered account.

- Complete the business registration form, providing details such as:

- Trade name and business activity

- Shareholder and director details

- Business structure and registered office address

- Upload the required documents (see below).

- Pay the registration fees online.

- Submit the application for review and approval.

Once submitted, the Ministry of Industry and Commerce (MOIC) will review the application and provide a decision within a few days.

Required Documents for Registration

To complete the registration, businesses must provide:

- Notarized MOA & AOA

- Trade Name Approval Certificate

- Initial Approval from MOIC & Other Authorities

- Shareholder & Director Identification Documents (Passport Copies, CPR for Bahrainis)

- Proof of Office Address (Lease Agreement or Virtual Office Agreement)

- Board Resolution (if applicable)

- Sector-Specific Licenses (if applicable)

Upon successful registration, the company will receive a Commercial Registration (CR) Certificate, allowing it to legally operate in Bahrain.

Step 5: Obtain a Commercial Registration (CR) Certificate

Once the business registration process is complete, the Ministry of Industry and Commerce (MOIC) will issue a Commercial Registration (CR) Certificate. This document officially recognizes the business as a legal entity in Bahrain and grants it the right to operate within the country.

Processing Time & Fees

- The processing time for obtaining a CR Certificate typically ranges from 1 to 5 working days, depending on the business type and whether additional approvals are required.

- Registration fees vary based on the business activity and structure but generally include:

- CR issuance fee: BHD 50–100 (varies by business activity)

- Annual CR renewal fee: Ranges between BHD 50–200

- Additional fees for specialized licenses (if applicable)

Renewal & Validity Period of CR

- The CR Certificate must be renewed annually through the Sijilat system.

- Businesses that fail to renew their CR on time may face penalties or suspension.

- Companies must ensure compliance with MOIC regulations and update any changes (e.g., ownership, business activity, address) to maintain an active registration.

5. Post-Registration Compliance & Requirements

After obtaining the CR Certificate, businesses must fulfill several post-registration compliance requirements to legally operate in Bahrain.

Registering with the Labor Market Regulatory Authority (LMRA) (For Hiring Employees)

If a business plans to hire employees, it must register with the Labor Market Regulatory Authority (LMRA) to obtain work visas and labor permits.

LMRA Registration Process:

- Create an employer account on the LMRA portal (www.lmra.bh).

- Submit company details and CR information.

- Apply for work permits for foreign employees, if needed.

- Pay labor fees as per LMRA regulations.

Bahrain has a Bahrainization policy, meaning companies must employ a certain percentage of Bahraini nationals, depending on the industry.

Obtaining a VAT Certificate (If Applicable)

Businesses in Bahrain must register for Value Added Tax (VAT) with the National Bureau for Revenue (NBR) if their annual turnover exceeds:

- BHD 37,500 (mandatory registration)

- BHD 18,750 (voluntary registration)

Steps to Register for VAT:

- Apply via the NBR portal (www.nbr.gov.bh).

- Submit CR Certificate and financial records.

- Receive VAT registration number and certificate.

- Comply with VAT filing and reporting obligations.

Failure to register for VAT when required may result in penalties.

Opening a Corporate Bank Account in Bahrain

A corporate bank account is essential for managing business transactions. To open a business account, companies must provide:

- CR Certificate & Trade License

- MOA & AOA

- Shareholder and director identification (passports, CPR)

- Proof of business address (lease agreement)

- Board resolution authorizing account opening

Major banks in Bahrain that offer business banking services include:

- National Bank of Bahrain (NBB)

- Bank of Bahrain and Kuwait (BBK)

- Ahli United Bank

- HSBC Bahrain

Getting Municipality & Industry-Specific Approvals

Some businesses require additional approvals from the municipality or sector-specific regulatory bodies, including:

- Municipality License (for physical offices, retail shops, and restaurants)

- Health Ministry Approval (for healthcare-related businesses)

- Central Bank of Bahrain License (for financial institutions)

- Industry-Specific Permits (for manufacturing, tourism, or construction sectors)

Businesses should check with relevant authorities to ensure they meet all industry-specific requirements.

Understanding Tax Obligations & Annual Compliance

Bahrain has a business-friendly tax environment, but companies must comply with certain financial regulations:

- Corporate Income Tax: Bahrain does not impose corporate tax on most businesses, except for oil and gas companies (taxed at 46%).

- VAT Compliance: Businesses must file VAT returns quarterly if registered for VAT.

- Financial Audits: Companies must maintain proper accounting records and may need annual audits, especially for shareholding companies.

6. Business Setup in Bahrain Free Zones

Overview of Bahrain’s Free Zones

The business setup in Bahrain has several free zones designed to attract foreign investors by offering tax incentives, streamlined regulations, and 100% foreign ownership. These free zones are ideal for industries such as logistics, manufacturing, technology, and financial services.

The main free zones in Bahrain include:

- Bahrain International Investment Park (BIIP) – Best for manufacturing, logistics, and industrial businesses.

- Bahrain Logistics Zone (BLZ) – Designed for logistics, warehousing, and distribution companies.

- Bahrain Financial Harbour (BFH) – A hub for financial services, banking, and fintech companies.

- Bahrain International Airport Free Zone – Ideal for aviation, cargo, and e-commerce businesses.

Key Benefits of Setting Up in Bahrain Free Zones

- 100% Foreign Ownership – No requirement for a local sponsor.

- Zero Corporate & Income Tax – No corporate or personal income tax.

- Full Repatriation of Profits – Businesses can send profits back to their home country without restrictions.

- Customs Duty Exemptions – Free zones offer duty-free imports and exports.

- Fast Business Setup – Simplified processes for company formation.

- Strategic Location – Easy access to GCC markets, particularly Saudi Arabia.

Registration Process & Requirements for Free Zone Businesses

The registration process for setting up a business in a free zone is slightly different from mainland Bahrain. Here’s how it works:

Step 1: Choose the Free Zone & Business Activity

- Select the most suitable free zone based on your industry.

- Ensure business activity is permitted in that free zone.

Step 2: Submit the Application

- Apply through the respective free zone authority’s portal.

- Provide the required documents, including:

- Passport copies of shareholders

- Business plan

- Lease agreement for office space in the free zone

- Memorandum & Articles of Association (MOA & AOA)

Step 3: Obtain the Business License

- After document verification, the free zone authority issues the business license and allows operations to commence.

Step 4: Apply for Work Permits & Visas

- Register with the Labor Market Regulatory Authority (LMRA) to hire employees.

- Apply for residence visas for investors and staff.

Setting up in a Bahrain free zone can be a fast-track process, often completed in 2–4 weeks.

7. Costs & Timelines for Business Registration in Bahrain

Government Fees & Processing Charges

The cost of registering a business in Bahrain depends on the business structure and licensing requirements. Below is an estimate of typical government fees:

| Service | Estimated Cost (BHD) |

| Trade Name Reservation | BHD 50 – 100 |

| Commercial Registration (CR) Fees | BHD 50 – 200 |

| Notarization of MOA & AOA | BHD 50 – 150 |

| Municipality License | BHD 100 – 300 |

| LMRA Work Permit (per employee) | BHD 100 – 200 |

| VAT Registration (if applicable) | Free |

Expected Registration Timeline

The business registration process in Bahrain is efficient and can be completed in a few days to a few weeks, depending on the business type and required approvals.

| Step | Timeframe |

| Trade Name Reservation | 1–3 days |

| Initial Approvals | 3–7 days |

| Drafting & Notarization of Documents | 2–5 days |

| CR Registration | 5–10 days |

| Municipality & Industry-Specific Approvals | 7–14 days (varies by industry) |

For free zone businesses, the process may take 2–4 weeks depending on approvals and office space requirements.

Additional Costs to Consider

Apart from government fees, businesses should also budget for:

| Expense | Estimated Cost (BHD per year) |

| Office Rent (Shared/Virtual) | BHD 500 – 2,000 |

| Physical Office Space | BHD 2,000 – 10,000 |

| Legal & Consultancy Fees | BHD 500 – 2,000 |

| Accounting & VAT Compliance | BHD 300 – 1,500 |

| Employee Salaries (if applicable) | Varies based on industry |

8. Common Challenges & How to Overcome Them

Starting a business in Bahrain is relatively straightforward, but entrepreneurs may face some challenges during the registration process. Here are the most common hurdles and how to overcome them.

1. Navigating Government Regulations & Paperwork

Challenge:

- Understanding Bahrain’s business laws, licensing requirements, and compliance procedures can be overwhelming.

- Multiple government entities (MOIC, LMRA, NBR, Municipality) may be involved, leading to a complex registration process.

Solution:

- Use the Sijilat system for streamlined online registration.

- Refer to the MOIC’s guidelines and seek assistance from professional consultants.

- Engage a business setup service to handle paperwork and compliance.

2. Understanding Foreign Ownership Restrictions

Challenge:

- While Bahrain allows 100% foreign ownership in most sectors, some industries (e.g., banking, telecom, insurance) require local partnerships or additional regulatory approvals.

Solution:

- Research Bahrain’s Foreign Investment Laws to determine eligibility.

- If required, find a local sponsor for restricted sectors.

- Consider free zones, which offer full foreign ownership with fewer restrictions.

3. Delays in Approvals & CR Issuance

Challenge:

- Some businesses experience delays in getting approvals from MOIC, LMRA, or sector-specific regulatory bodies.

- Notarization and document verification may take longer than expected.

Solution:

- Ensure all documents are complete and meet government standards before submission.

- Work with a business consultant to speed up the approval process.

- Follow up with government authorities regularly to check application status.

4. Solutions & Professional Assistance Options

- Legal & Business Consultants: Experts can handle paperwork, compliance, and regulatory approvals.

- Online Registration Services: Platforms like Sijilat and LMRA e-services simplify the process.

- Bahrain Economic Development Board (EDB): Offers guidance and support to foreign investors.

By addressing these challenges with the right approach, businesses can ensure a smooth and efficient registration process.

9. Why Choose Professional Assistance for Business Registration?

Setting up a business in Bahrain requires handling multiple steps, from approvals to licensing. Working with business setup consultants can make the process easier and faster.

Benefits of Hiring a Business Setup Consultant

- Time-Saving: Experts handle paperwork and approvals, reducing delays.

- Compliance Assurance: Ensures your business meets all legal and regulatory requirements.

- Foreign Investment Guidance: Helps foreign entrepreneurs navigate ownership laws and restrictions.

- Industry-Specific Expertise: Consultants assist with specialized licenses for regulated sectors.

- End-to-End Support: From company registration to tax filing and visa processing.

How Expert Services Can Streamline the Process

Professional consultants offer:

- Pre-registration advisory to choose the right business structure.

- Trade name registration and MOIC approvals.

- CR certificate issuance & licensing support.

- Bank account setup assistance.

- Ongoing compliance & tax advisory.

Overview of BKR’s Business Setup Services in Bahrain

BKR provides expert guidance for businesses looking to establish operations in Bahrain. Our services include:

✔️ Company Formation & CR Registration

✔️ Trade Name Reservation & MOIC Approvals

✔️ LMRA Work Permits & Visas

✔️ Corporate Bank Account Assistance

✔️ Tax Registration & Compliance

✔️ Municipality & Industry-Specific Licensing

With our local expertise and professional support, we help businesses set up in Bahrain hassle-free.

Bahrain offers a business-friendly environment, 100% foreign ownership, low taxes, and strategic access to GCC markets, making it an ideal destination for entrepreneurs and investors. Setting up a company here is a structured process, and with the right guidance, it can be completed smoothly and efficiently.

Recap of Key Steps in the Registration Process

1️⃣ Choose the Right Business Structure – Decide between WLL, SPC, BSC, Free Zone Company, or a Branch Office.

2️⃣ Reserve a Trade Name & Get Initial Approvals – Secure a unique business name and obtain approvals from MOIC.

3️⃣ Draft & Notarize Business Documents – Prepare and authenticate the MOA, AOA, and other required legal documents.

4️⃣ Register with the Bahrain Commercial Registry – Submit all necessary documents via the Sijilat system.

5️⃣ Obtain the CR Certificate & Licenses – Receive your Commercial Registration and complete industry-specific approvals.

6️⃣ Post-Registration Compliance – Register with LMRA, open a corporate bank account, and comply with tax regulations.

7️⃣ Consider Free Zone Options – Explore the benefits of operating in Bahrain’s business-friendly free zones.

8️⃣ Work with Professional Consultants – Speed up the process and ensure full compliance with expert assistance.

Encouragement to Start a Business in Bahrain

Bahrain provides unparalleled advantages for businesses, from zero corporate tax to fast-tracked company registration. Whether you’re an entrepreneur, a startup, or a multinational corporation, Bahrain’s pro-business policies and investment incentives make it an ideal place to grow.

With a strategic location, strong legal framework, and supportive government initiatives, there has never been a better time to set up your business in Bahrain! 🚀

Call to Action – Get Expert Help with BKR

Setting up a business can be complex, but you don’t have to do it alone. BKR provides expert company formation services in bahrain to guide you through every step of the registration process.

📞 Contact BKR Today!

📍 Location: Bahrain

📧 Email: infobkr@bkrgroup.co

🌍 Website: https://bkrsupportservices.com/

📲 Call/WhatsApp: +973 35615033

✅ Let’s turn your business vision into reality—start your journey in Bahrain today! 🚀